Saving for Your Child's College Tuition

Your child's education (for both pre-college and college) is expensive. For example, private preschool can cost upwards of $50K with most Ivy League schools costing the same (and that’s just for one child).

So it’s worthwhile to start thinking of ways to save for your child’s schooling. The most common way to do this is by opening a 529 Plan. It’s a tax-advantaged investment account sponsored by the Government that grows tax-free and is not taxed upon withdrawal.

At a high-level, here are some facts about a 529 Plan:

After-tax contributions are made to the investment account

States have different contribution limits

Accounts grow tax-free and no taxes are paid upon withdrawal

Contributions (i.e. the principal) can be withdrawn without any penalty

Penalty is incurred if withdrawal is made for non-qualified expenses

Can withdraw up to $10K per year for pre-college education

Investment options are typically limited to ETFs and Mutual Funds

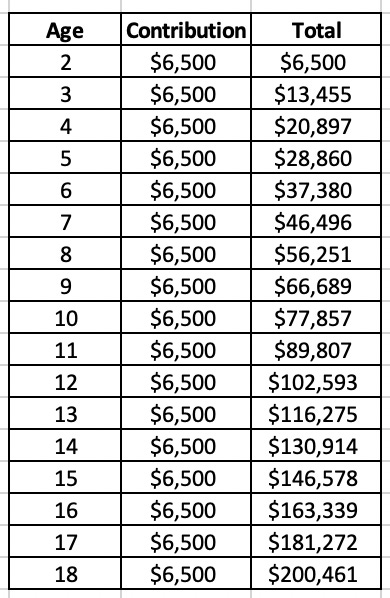

Let’s put this into practice. Assume you have a 2-year-old child who will start college at 18 years old. Assume their college will cost $200K and you invest in a standard S&P 500 ETF via a 529 Plan that will average 7% per year:

So if you contribute $6500 per year to your 529 Plan, you can be on your way of having enough for your child’s tuition when they enter college. That’s about $550 per month.

There are more subtleties to the 529 Plan which are not addressed above which I’m happy to discuss further.